.

How Healthy is your Customer Healthscore? Take the 5 question quiz to rate your maturity & get instant recommendations!

How Healthy is your Customer Healthscore?

Take the 5 question quiz to rate your maturity & get instant recommendations!

The Reef Current

The Reef Current > The Healthscore Mirage: Effective Customer Scoring is Game-Changing but Elusive

The Healthscore Mirage: Effective Customer Scoring is Game-Changing but Elusive

CEO & Founder

Reef.ai

John Gleeson

CEO & Founder

Success Venture Partners

The healthscore serves as a common foundation for customer success strategies, yet it is often misinterpreted and mishandled due to a lack of recognition regarding the challenges of effective customer scoring.

Many individuals view a healthscore as a numerical or categorical (red, yellow, or green) assessment resulting from calculations involving various inputs, weighted according to their perceived impact on customer well-being. While this perspective isn't entirely inaccurate, it only scratches the surface.

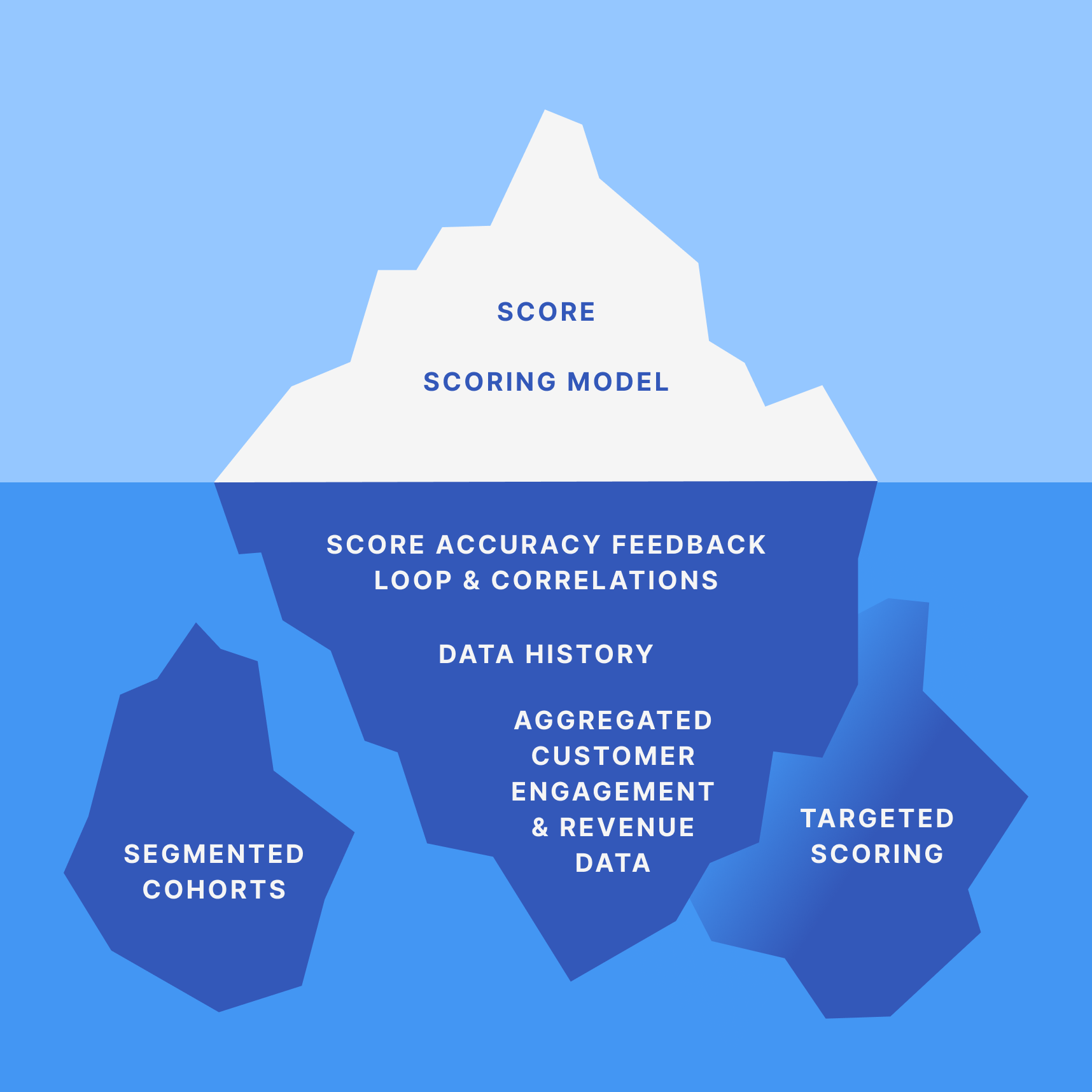

A customer score and its underlying scoring model are akin to the visible tip of an iceberg; there exists a substantial amount of work beneath the surface required to develop an accurate score that can be continually enhanced.

Healthscores can be one of the most challenging aspects of Customer Success to perfect. If your model is too sensitive, everything turns red and appears problematic. If it's not sensitive enough, you may overlook critical flags that could significantly impact where you allocate your efforts. Even worse are models where nothing is definitive, and everything is in the yellow, rendering the entire score useless.

Early in my career as a Customer Success leader, I relentlessly pursued the ideal healthscore, but achieving that perfection was always elusive. Moreover, when I finally believed I had something useful, the impact on churn didn't meet my expectations. I recall going into the end of the quarter with a dashboard full of green accounts, only to end up with a much lower retention rate than anticipated, especially when a key account that was in the green churned.

While all components of our healthscore were indeed green — we had robust product usage, the customer utilized various aspects of the product, paid promptly, and even gave us a favorable NPS score — the score let us down because it had led to complacency in our service model. We hadn't spoken to the customer in over three months, all because the score was green.

In reality, this failure wasn't so much a flaw of the healthscore itself as it was a flaw in how I managed it. I came to view healthscores not merely as an indicator of my business's health but as a tool to make my business healthier. This distinction is crucial.

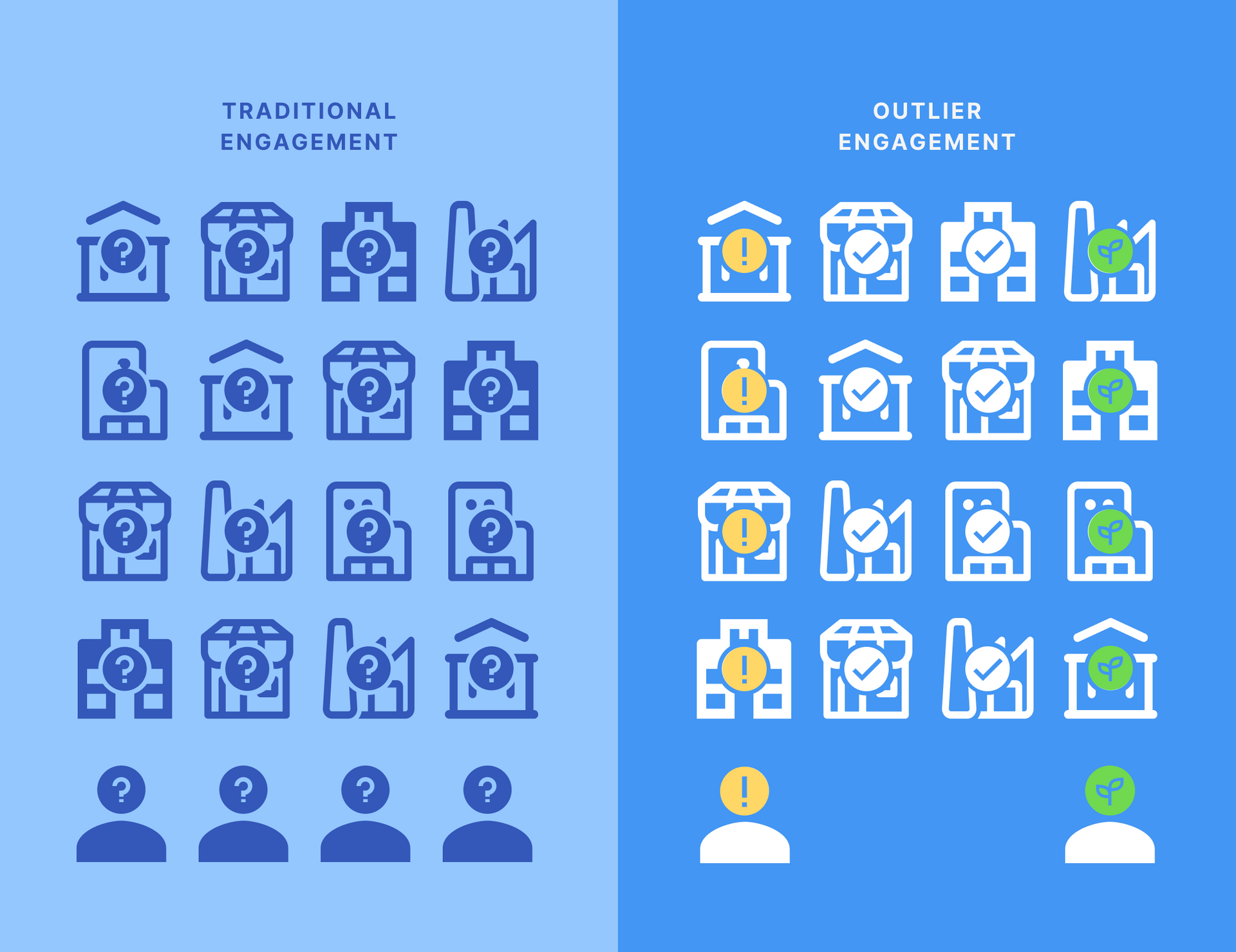

Achieving this requires meticulous attention to detail and an understanding of what distinguishes each account from others in similar cohorts. These differences can be either positive or negative, but the key is to identify the outliers and take appropriate action to bring the account back to the center. This is why I'm so enthusiastic about what reef.ai is developing!

Brent Grimes and reef.ai have conducted extensive research on customer scoring and its impact on retention and growth. I had the opportunity to sit down with Brent to gain a better understanding of why healthscores are more complex than most people realize.

John: Brent, before we delve into scoring, I've often heard you mention that the "outlier" customer engagement model represents the future of Customer Success. Could you elaborate on what you mean by outlier customer engagement and why you believe it embodies the future of Customer Success?

Brent: Hi John, of course. Outlier customer engagement is a model where companies monitor their customers and selectively invest in customers showing signs of growth potential or churn risk. It means moving away from traditional, linear CS models where you do a little bit with most or all customers in favor of an outlier model that enables companies to improve gross retention and net retention with fewer resources.

This is critical because virtually everyone in Customer Success is being asked to do more with less and the traditional linear model is resource heavy and doesn’t scale well.

Running an outlier model requires that companies establish the data and scoring capabilities to ensure they are placing the right bets. Reef has a blueprint for outlier customer engagement that helps companies establish the data and scoring foundation they need to execute this model.

The Reef blueprint is called the

Customer

Outlier

Revenue

Engagement (CORE) Model. This model enables companies to prioritize resource investments where revenue impact is greatest.

In order to run the CORE model, there are a set of capabilities that companies need to establish. The right data and data history build the foundation and enable accurate scoring. Then visualization and workflow make it easy for teams to identify outlier customers and prioritize their time.

John: Why is accurate customer scoring so important in this outlier model?

Brent: Committing to an outlier model can be powerful but it requires you to decide which customers you will engage and more importantly, which customers you will NOT engage. You can’t count on weekly check-ins or QBRs to surface risk so you have to trust your data and your scoring.

Your iceberg analogy above captures this perfectly. Betting your business on an accurate score requires going beyond surface-level scoring and committing to measuring and continuously improving scoring accuracy.

John: The outlier customer engagement model makes so much sense but I can imagine that some leaders might be overwhelmed with the idea of changing their CS model, or they just don’t have time or resources to deal with change management. How do you advise people when they are concerned about this shift?

Brent: Great point, John. We hear that a lot. The outlier model really resonates but it can be difficult to find the perfect time to transition. The great thing about the CORE model is that it doesn’t have to be big bang. You can take the first steps and build the foundation (DATA AND SCORING) in the background and then gradually shift your customer engagement model once you have confidence in your data and scoring.

Reef has a starter offering focused on data aggregation and scoring that will give any company the data foundation, data history, and scoring improvement feedback loop required to confidently score customers.

John: That’s powerful. The idea of plugging in a system to build a rich data foundation for customer scoring seems like a no brainier. Companies can put themselves in a position to improve performance without having to disrupt their immediate priorities and then they can incrementally evolve their model based on improved scoring and visibility. What else has Reef learned in your exploration of healthscores? What are some common pitfalls that you’ve seen with customer scoring?

Brent: Great question, John. We do see some common patterns. There are three mistakes we see the most. I’ll give you the countown from 3 to 1 with 1 being the most common mistake.

#3 - Too many score components are subjective and need to be updated by people.

People are not great at keeping information up to date in systems. Scoring models that are overly-reliant on data input by people are often out of date and inaccurate.

#2 - Companies don’t capture history.

Without history of the score, the score inputs, and related revenue data, it is impossible to measure score accuracy and identify which score components are leading to false positives or false negatives.

#1 - The score contains too many components.

Many compaines create a score that consists of a dozen or more components. Overly broad scoring models dilute the impact of each component and make it difficult to discern what really matters.

John: All of those resonate with me. In my past CS leadership roles, I feel like I’ve learned each of those lessons the hard way. Given the current economic climate, a lot of people I speak with have difficulty getting budget for anything new. Do you have any examples or models to help people justify an investment in improved customer scoring?

Brent: You’re right, John. It is not easy to get access to budget right now and it is critical to show clear ROI for any potential investment.

The good news is that we have a straightforward and logical way to articulate the financial impact of improved customer scoring. Here’s an example we've seen firsthand:

Scoring Business Case Example

Imagine you analyze your healthscore’s performance and realize that at renewal, 22% of “green” customers churn partial or full value. And the analysis further uncovers that even though overall product activity is high, engagement for certain distinct product lines is low for these customers and they ultimately reduce or churn those products at renewal. By modifying the healthscore or introducing a new score per product line, you can spot this signal well in advance of renewal and make an investment to improve adoption of the specific product lines. As a result, you can directly reduce churn in these scenarios.

Assumptions

- Expiring Annual Renewal ARR Amount: $60M

- # of expiring customers: 800

- Average renewal value: $75K

- % of customers who are “Green” before renewal: 75%

- % of “Green” customers with churn: 22%

- Average “Green” customer churn amount $25K

- Assumed saved churn % from product line scoring + action: 20%

Calculations

- # of “Green” customers with churn:

- 800 Customers * 22% = 176 Customers

- Value of “Green” customer churn

- 176 Customers * $25K = $4.4M

- Saved churn ARR:

- $4.4M * 20% = $880K

- Gross Retention Rate Improvement

- $880K / $60M = 1.5 PTS

Additionally, we have a business case template that I’m happy to share with anyone that’s interested.

John: Here’s my final question. If someone wanted to better understand how well they are scoring their customers or get more information on Reef where can they go?

Brent: We have a really cool,

free healthscore assessment that anyone can use to find out their current scoring maturity and to get specific recommendations on how they can improve their scoring model. It takes less than 2 minutes and the recommendations are pretty thorough. Additionally, Reef will donate $10 to the

Coral Reef Alliance for every survey submitted between now and the end of the year.

Or, to learn more about Reef more generally, people can explore

Reef.ai or

schedule time with us directly.

A conversation with Reef.ai's Brent Grimes

Stay Connected

Have Feedback or Questions?

Follow us on Linkedin

Follow us on YouTube